Business Dispute Lawyer Tampa, FL

Our Tampa, FL business dispute lawyer has represented many clients who ended up in business disputes over business loans. Personal guarantees for business loans are often required by banks and other lending institutions. When a business owner applies for a loan, they must often personally guarantee the loan will be repaid, even if the business owner has to use personal assets to do so.

Our Tampa, FL business dispute lawyer has represented many clients who ended up in business disputes over business loans. Personal guarantees for business loans are often required by banks and other lending institutions. When a business owner applies for a loan, they must often personally guarantee the loan will be repaid, even if the business owner has to use personal assets to do so.

For corporations with multiple business owners, some banks will ask for a personal guarantee from each owner. At times, even spouses of business owners are asked to co-sign a personal guarantee. If the terms of the guarantee are not fully understood, a business owner can be made vulnerable to a potential personal bankruptcy situation when the loan is due. This is one reason why it is so important to have our business lawyer examine any lender contract you are considering entering into before you sign it.

Personal Liability Extends Longer Than Many Business Owners Realize

A common problem with personal guarantees involves businesses with multiple owners. If one owner leaves the business, they may still be liable for any loan guarantees that they committed to. If their past business venture fails, even years down the road, under the terms of standard loan arrangements, their personal guarantee can be called up to pay off the remaining balance on the loan. This also applies to any loan restructuring that occurs, even if the former owner was not involved in the renegotiation process. Once signed and notarized, a personal guarantee extends until the initial loan (plus any renewals or credit extensions) has been completely paid in full.

Business Owners Do Have Options

Our Tampa business dispute attorney knows that for joint ventures, co-signees have the option to sign the promissory notice itself versus drafting a personal guarantee. This provides a better level of protection because the owners will no longer be liable for any remaining balances if the loan is renegotiated or rolled over.

Some lending institutions will negotiate the terms and settlement of a personal guarantee for both current and former business owners. In certain cases, if the owner undergoes asset protection planning, they can be protected from having to repay the entire amount stated on the guarantee. However, the majority of the remaining loan balance will still need to be repaid.

Contact a Business Law Firm for Legal Assistance

Business owners should obtain a professional review of any business loan agreements asking for or requiring a personal guarantee, by our business lawyer. All terms and conditions must be carefully reviewed, and all business loans should be negotiated to obtain satisfactory terms for all parties involved.

If you already find yourself dealing with issues for a loan you have entered into, call our Tampa business dispute lawyer to find out how we can help. Please call Hoyer Law Group, PLLC today for a consultation.

A nonprofit corporation (also called a not-for-profit organization), is a legal entity formed under (and in compliance with), the corporation laws of its state. It is established to provide a service or benefit rather than to make a profit. Any profit it makes must be delivered back into the entity, and not taken by an individual for his or her own gain. In other words, a nonprofit has no shareholders per se; consequently, there is no one to whom to distribute dividends. Many kinds of nonprofits exist, including the following:

- Public benefit organizations that are mission or value driven, such as Kickstarter, Plum Organics, Giving Assistant, etc.

- Mutual benefit organizations, such as labor unions, chambers of commerce, veterans’ groups, etc.

- Religious organizations, such as churches, synagogues, interfaith groups, etc.

- Charitable organizations, such as the Red Cross, Catholic Charities, United Way, the Salvation Army, etc.

- Political organizations, such as Green Tech Action Fund, Republican Jewish Coalition, League of Conservation Voters, etc.

- Social clubs, such as college fraternities and sororities, country clubs, dinner clubs, etc.

- Consumer cooperatives, such as credit unions, housing cooperatives, utility cooperatives, etc.

501(c)(3) Organizations

Some, but not all, nonprofit organizations elect to become 501(c)(3) organizations, a special tax-free status granted by the Internal Revenue Service. In order to prevent problems from arising, it is essential that you meet all the requirements to operate under this organization type. To qualify, our Tampa business dispute attorney can make sure that you have one of the following types of purposes:

- Charitable

- Religious

- Educational

- Scientific

- Literary

- Public safety

- National or international amateur sports competition

- Prevention of cruelty to children or animals

- A charitable purpose, in turn, can include such things as the following:

- Providing relief to poor, distressed or underprivileged people

- Erecting and/or maintaining public buildings, monuments, etc.

- Eliminating discrimination and prejudice

- Defending human and civil rights

- Combating community deterioration

A 501(c)(3) organization is not only exempt from paying income taxes, but also sales taxes. In addition, its donors can deduct the amount of their donation from their income taxes.

Setting Up a Nonprofit

If you’re interested in starting a nonprofit corporation, and want to ward against problems from developing in the future, then your first step should be to seek the advice and counsel of our business attorney. We can not only help you choose an appropriate and available corporate name, but also advise you of all the things you must do to form a corporation in your state. After drafting your Articles of Incorporation and Bylaws, we can then walk you through the process of filing your corporation with your state’s secretary of state’s office and obtaining your corporate seal. Finally, if you wish to become an A 501(c)(3) organization, we can help you do so. Don’t hesitate to reach out to us at Hoyer Law Group, PLLC for further business related guidance!

Tampa Business Dispute Infographic

Vicarious Liability And Your Business

When calculating the risk that a business may face in the course of its operation, it is important for business owners to factor in the risk posed by their employees’ actions. Under Florida law, employers may be found liable for their employees’ actions through vicarious liability. This can lead to serious serious lawsuits filed against your company. If you are facing this type of action, or want to learn more about protecting yourself in the future, contact our Tampa business law firm.

The Vicarious Liability Doctrine

Through the legal doctrine of vicarious liability, a person who is injured by an employee can receive compensation from the employer if the employee’s conduct causing the injury was within the scope of the employee’s employment. What constitutes an employee’s “scope of employment” varies. Courts also consider the motivation for the employee’s conduct.

Intentional Acts

Generally, employers are not held liable for certain intentional acts by their employees. However, if the employee was even partially motivated by a desire to act on behalf of the employer, and partially by a desire to release his own aggression, the employer may be held liable. An example of this can be a security guard dealing with a difficult customer. If the security guard punches the customer and breaks his nose, the employer will most likely be held liable for any losses the injured customer suffers due to their injury. This can be a very expensive punch in the nose since the damages can include medical bills, lost wages, pain and suffering, and more.

While company policy prohibiting employee conduct that could open the employer to liability is a good idea, it is not guaranteed to release the employer from future liability. Even if it is company policy for security guards not to punch or physically harm customers, and the security guard in the example above was in clear violation of that policy, the employer may still be held vicariously liable for the customer’s injuries.

Employer/Employee Relationship

Another important element to consider from the employer’s standpoint is whether or not there is a clear agency relationship between the employer and the employee. If the person who causes the accident is undisputedly an employee, an agency relationship is easier to prove. However, if the person who causes the accident is an independent contractor, it is more difficult to prove the person was acting as an agent, and the business which contracted him may not be liable.

Business Structure

Entrepreneurs weighing different business forms under which to structure their businesses should remember that they can limit their personal exposure to the risk of vicarious liability by organizing their businesses appropriately. Using a corporation or a limited liability company is a better way to limit risk than forming a business as a sole proprietor.

Contact Us for A Legal Consultation

Businesses can also limit their liability for employee actions by taking appropriate legal steps that can protect them from legal actions. Contact Hoyer Law Group, PLLC to schedule a confidential consultation with our skilled Tampa business lawyers and find out what steps you can take to protect your company from employee actions. Whether you are a new business owner who needs help structuring your organization or own an established corporation seeking support in conjunction with general counsel, our team is here for you.

Tampa Business Dispute Statistics

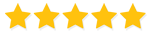

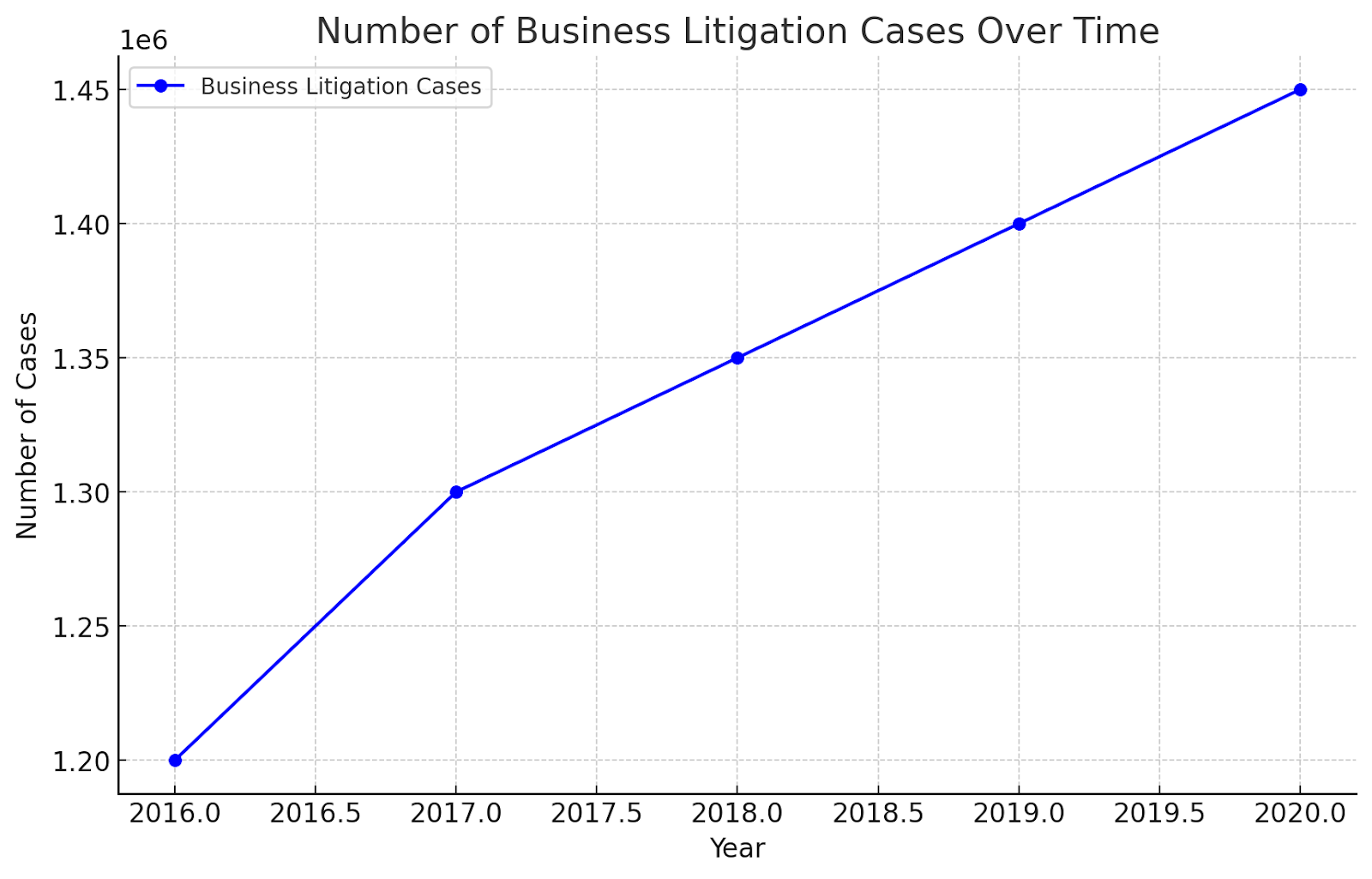

Business disputes are common in the corporate world, involving disagreements between business partners, employees, customers, suppliers, or other stakeholders. According to the American Bar Association (ABA), business disputes often arise from breaches of contract, intellectual property issues, and employment-related conflicts. Most civil litigation cases in the U.S. involve some form of business dispute, with an estimated 10% of businesses experiencing legal disputes annually.

A significant source of business disputes is contract issues. According to the National Arbitration Forum, over $1.2 trillion worth of business litigation cases are filed in federal courts each year. Breach of contract is the most common type of case, accounting for nearly 60% of all business disputes. Another major contributor to business disputes is intellectual property rights. The United States Patent and Trademark Office (USPTO) estimates that nearly 30,000 patent disputes occur yearly.

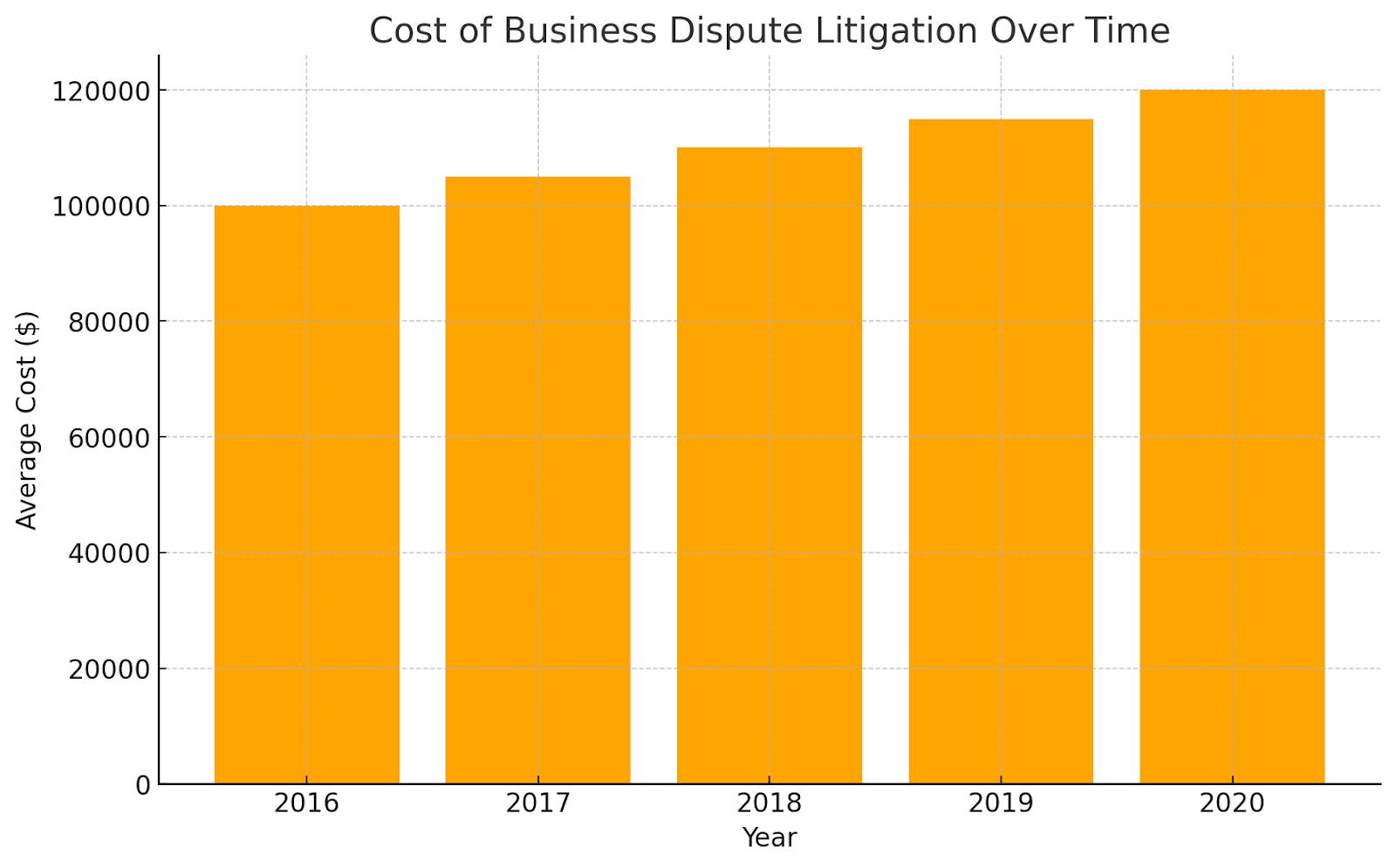

Employment-related disputes are common, including wrongful termination, discrimination, and wage and hour violations. According to the Equal Employment Opportunity Commission (EEOC), the agency handled over 67,000 discrimination claims in 2020. These disputes can lead to costly legal battles and significant financial repercussions for companies, with the average cost of defending against an employment discrimination claim exceeding $100,000.

The following charts illustrate key trends related to business disputes:

Business Disputes FAQs

When businesses face disputes, it’s essential to understand the potential outcomes before taking any action. These disputes can arise from a variety of issues, such as contract breaches, partnership disputes, or conflicts with vendors or clients. Having a clear understanding of the possible resolutions can help business owners make informed decisions about how to proceed. Our Tampa, FL business dispute lawyer can provide valuable guidance in handling these situations and determining the best course of action.

What Are the Possible Outcomes Of a Business Dispute?

Business disputes can result in several outcomes, depending on the nature of the conflict and the approach taken to resolve it. Some common outcomes include settlements, where both parties agree to a resolution without going to court, or court rulings, where a judge makes a final decision. Other potential outcomes may include mediation or arbitration, where a neutral third party helps the disputing parties reach an agreement. The specific outcome will depend on the circumstances of the dispute and the willingness of both parties to negotiate or compromise.

Is Settlement a Common Resolution in Business Disputes?

Yes, settlements are a very common outcome in business disputes. Many businesses prefer to settle disputes out of court to avoid the time, expense, and uncertainty of a trial. Settlement negotiations can take place at any stage of the dispute process, and they often result in a mutually agreed-upon resolution that both parties find acceptable. Our business lawyer can assist in negotiating a settlement that protects your interests while resolving the conflict efficiently.

How Does a Court Ruling Differ From Other Outcomes?

A court ruling is a formal decision made by a judge after both parties have presented their cases in court. Unlike settlements, which are agreed upon by the parties involved, a court ruling is imposed by the judge and is legally binding. This outcome is often seen as a last resort when other methods of resolution, such as negotiation or mediation, have failed. While a court ruling can provide a definitive resolution to a dispute, it also comes with risks, including the potential for an unfavorable decision. Working with our legal team can help you assess the risks and benefits of pursuing a court ruling.

What Is the Role Of Mediation in Business Disputes?

Mediation is a process in which a neutral third party, known as a mediator, helps the disputing parties communicate and work toward a resolution. Unlike a judge in a court case, a mediator does not make decisions or impose outcomes; instead, they facilitate discussions to help the parties reach a voluntary agreement. Mediation is often faster and less formal than going to court, and it allows the parties to have more control over the outcome. This method is particularly useful in disputes where both parties are willing to collaborate to find a solution. Our lawyer can represent you during mediation to make sure that your interests are protected throughout the process.

Is Arbitration a Viable Alternative to Litigation?

Arbitration is another alternative to litigation that involves a neutral third party, called an arbitrator, who hears both sides of the dispute and then makes a binding decision. Unlike mediation, where the outcome is negotiated, arbitration results in a decision made by the arbitrator, similar to a court ruling. Arbitration is often faster and more private than court litigation, making it an attractive option for many businesses. However, because the arbitrator’s decision is usually final and binding, it’s important to approach arbitration carefully. Consulting with our business attorney can help you determine if arbitration is the right choice for your situation.

When facing a business dispute, understanding the possible outcomes is vital to making informed decisions. Whether you’re considering settlement, court litigation, mediation, or arbitration, each option has its own set of advantages and challenges. At Hoyer Law Group, PLLC, we’re here to help you understand these choices. We have earned the Family Friendly Business Award™, an honorable distinction related to our workplace policies. If you’re dealing with a business dispute, contact us today to speak with our Tampa business dispute lawyer who can guide you toward the best legal solution for your situation.

Tampa Business Dispute Glossary

As a trusted business lawyers in the Tampa area, we understand that legal terminology can feel overwhelming for business owners. At our firm, we aim to simplify this process, empowering you to make informed decisions when handling business disputes or structuring your operations. We work on a case-by-case basis or you can take advantage of our monthly retainer services for general counsel needs. Below, we’ve provided a glossary of key terms to help you better understand some of the concepts involved.

Personal Guarantee

A personal guarantee is a contractual agreement where an individual commits to repaying a business loan if the business cannot fulfill its obligations. This often requires the individual to use personal assets as collateral, exposing them to potential financial risk. For example, when a small business owner co-signs a loan, their home or savings could be at stake if the company defaults.

We often see cases where personal guarantees have far-reaching implications, especially in partnerships where one business owner exits, only to find themselves still liable for outstanding debts. Reviewing these agreements with our business lawyer beforehand is essential to protecting your financial security.

Vicarious Liability

Vicarious liability refers to the legal responsibility an employer has for the actions of its employees when those actions occur within the scope of their employment. For instance, if an employee causes an accident while performing their job duties, the employer may be held accountable for the resulting damages.

Consider a scenario where a delivery driver for a business causes a traffic accident while on the job. Even if the employer wasn’t directly involved, they could still be sued for damages. Employers can mitigate these risks through well-drafted employment policies and legal strategies.

Mediation

Mediation is an alternative dispute resolution process where a neutral third party helps disputing parties reach a mutually acceptable agreement. Unlike litigation, mediation is less formal and often quicker, allowing business owners to preserve relationships while resolving conflicts.

For example, if two business partners disagree about profit distribution, mediation can help them come to a fair resolution without the cost and stress of a court battle. A skilled mediator facilitates discussions and proposes solutions, but the final agreement rests with the parties involved.

Arbitration

Arbitration offers another method for resolving disputes outside the courtroom. Here, a neutral arbitrator listens to both sides and issues a binding decision. Arbitration can be particularly useful for resolving disputes discreetly and efficiently, such as conflicts over contracts or vendor agreements.

Imagine a scenario where a vendor claims a business breached their contract. Rather than enduring a lengthy court process, arbitration allows both parties to present their case in a private setting, with the arbitrator’s ruling serving as the final resolution.

Articles Of Incorporation

Filing Articles of Incorporation is a critical step in formally establishing a corporation. This document outlines essential details such as the corporation’s name, purpose, structure, and authorized shares. Properly drafting these articles can protect business owners from personal liability while laying the foundation for successful operations.

For example, a Tampa entrepreneur starting a tech company would file Articles of Incorporation to secure legal recognition, making it easier to attract investors and shield personal assets.

Supporting the Success of Your Business

Whether you’re facing a dispute over a personal guarantee, seeking clarity on vicarious liability, or need guidance on arbitration, we’re here to help. At Hoyer Law Group, PLLC, our team has decades of experience assisting businesses in Tampa and beyond. If you need legal advice or representation for business law matters, don’t hesitate to reach out. Let us work together to protect your business and resolve your disputes effectively. Call now to schedule a consultation where we will review your business goals, address your concerns, and outline a strategic path forward.